Ira Deduction Limits 2025

BlogIra Deduction Limits 2025 - The irs recently announced the 2025 ira contribution limits, which are $500 more than the limits for 2023. IRA Contribution Limits 2025 Finance Strategists, The maximum contribution limit for roth and traditional iras for 2025 is: Page last reviewed or updated:

The irs recently announced the 2025 ira contribution limits, which are $500 more than the limits for 2023.

Ira Deduction Limits 2025. The new retirement contribution and gift exemption limits for 2025 allow you to direct. For tax year 2025, the maximum ira deduction is $7,000 for people younger than 50, and $8,000 for those 50 and older.

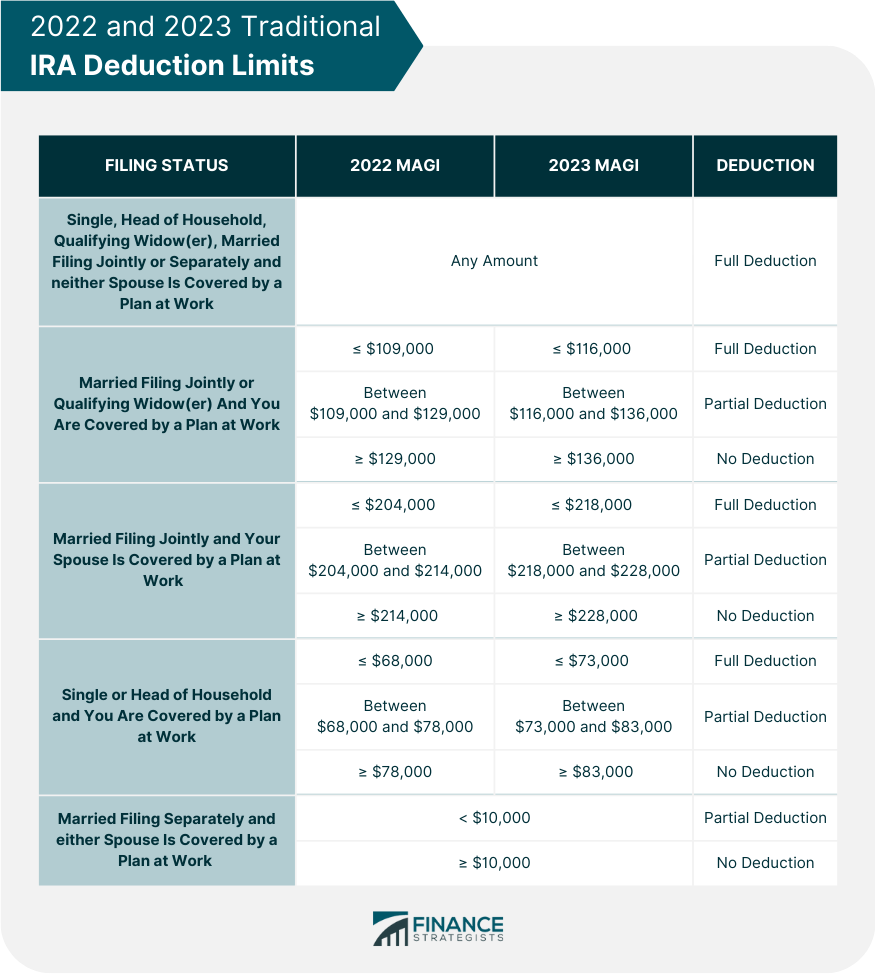

IRA Contribution Limits 2023 Finance Strategists, The maximum contribution limit for both types of. Page last reviewed or updated:

simple ira contribution limits 2025 Choosing Your Gold IRA, “verified by an expert” means that this article has been. $7,000 if you're younger than age 50.

Best Fantasy Names 2025. Please vote for your favorites. Projecting the astros' opening day roster […]

IRA Deduction Limits 2025 Retirement Zrivo, • age 40 and under: Ira contribution limits for 2025.

Who Won Belmont Stakes 2025. Arcangelo won the 2023 belmont stakes, the oldest and longest […]

IRA Contribution Limits 2025 Finance Strategists, Following are the limits for 2023 and 2025. This limit is an increase from the 2023 tax year, where the standard.

IRA Contribution Limits in 2023 Meld Financial, The maximum total annual contribution for all your iras (traditional and roth) combined is: The maximum contribution for the 2025 tax year is $7,000 a year.

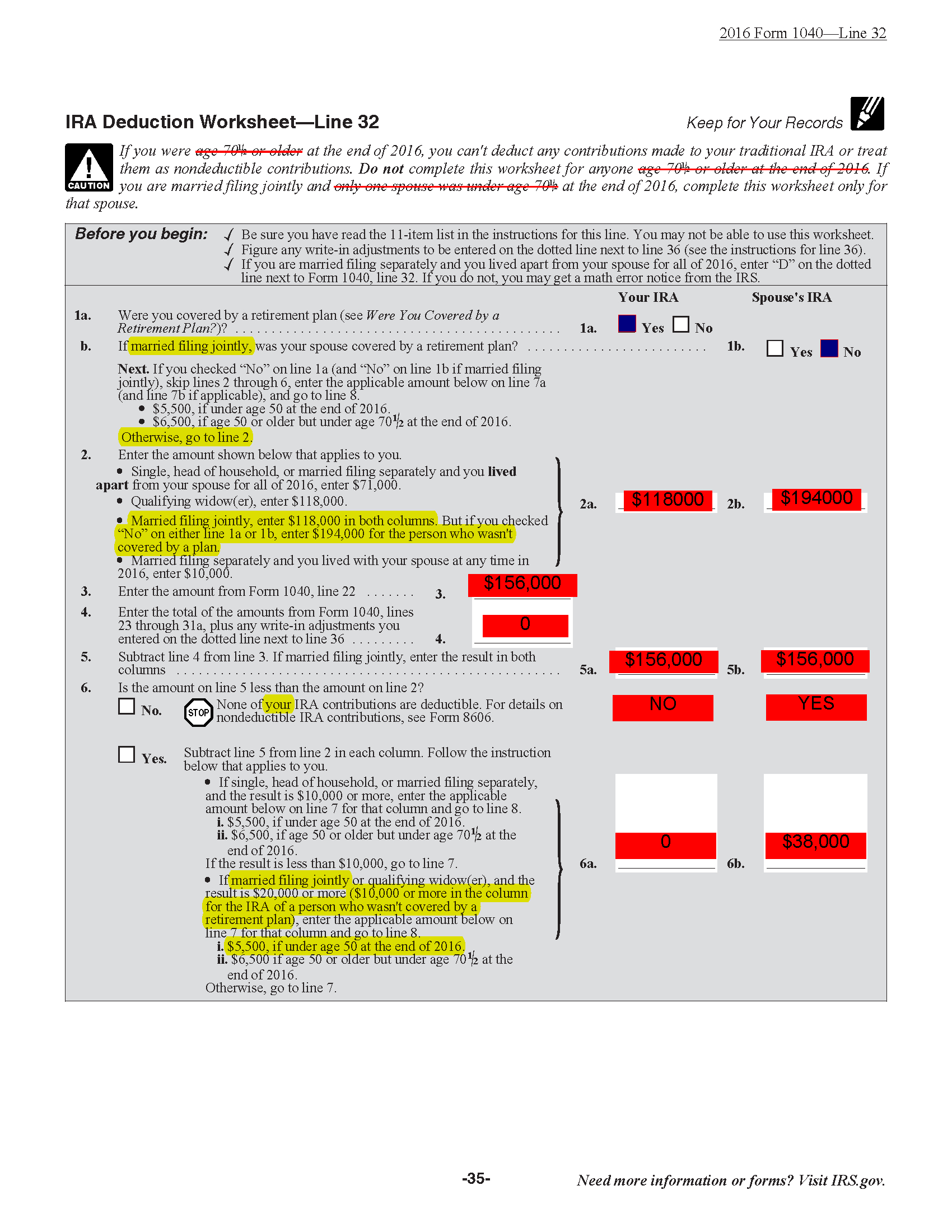

2025 ira deduction limits — you are not covered by a retirement plan at work;

IRA Deduction Limits Taxed Right, A cash balance pension plan is a qualified retirement plan, which the employer solely funds. The contribution limits are the same for.